Donating stocks, bonds, or mutual funds to the Grand Canyon Trust is a tax-wise and simple way to help safeguard the Grand Canyon and the entire Colorado Plateau.

When you transfer appreciated securities that you’ve held for at least one year, there are immediate financial benefits to both you and the Trust. Your gift is greater than if you sold the stock yourself and donated what remained after paying capital gains tax.

The details

- You can claim an immediate charitable tax deduction for the full fair market value of the securities that you donate.

- You avoid capital gains tax on the appreciation.

- The Trust immediately sells the securities to support our priority conservation work, without paying any capital gains tax.

Example

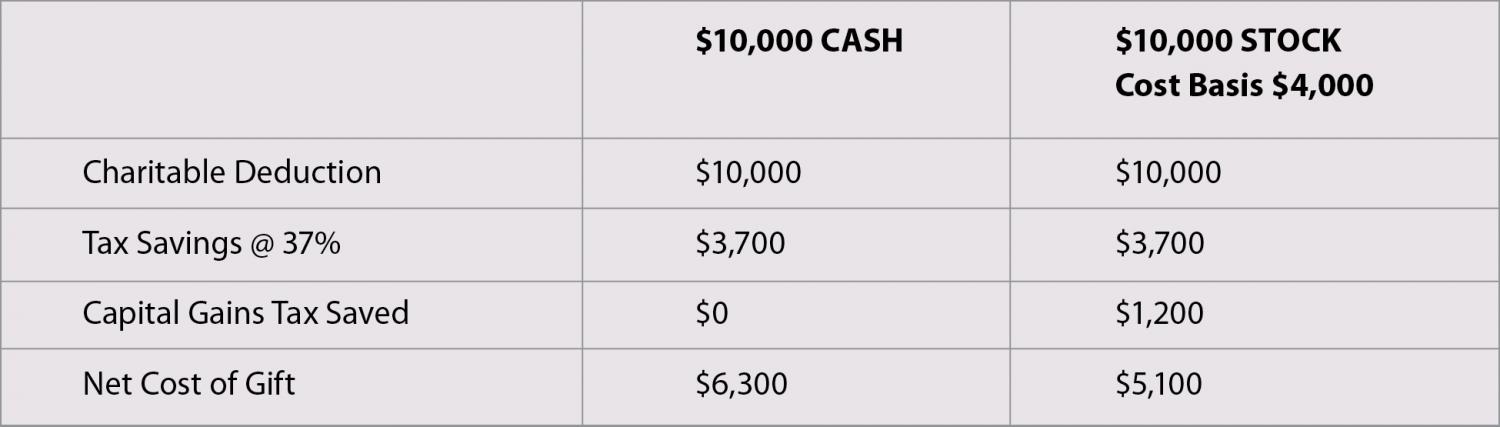

Here is a sample comparison of a cash gift of $10,000 with a gift of securities worth $10,000 that was originally purchased for $4,000, with an unrealized gain of $6,000. (Assumptions: Donor is in 37 percent income tax bracket and 20 percent capital gains tax bracket, not including any state tax.)

To make a gift of stock, please follow these instructions:

- Please notify us of your intent to give a gift of stock to ensure we watch for your gift and then appropriately acknowledge your contribution.

- To transfer the stock, share this information with your broker/advisor:

Schwab

DTC: 0164

Grand Canyon Trust

Account Number: 3352-0234

For more information about how to name the Trust in your will or estate plan, please contact us at (928) 774-7488 or philanthropy@grandcanyontrust.

** Please note the Grand Canyon Trust cannot render tax or legal advice. We urge you to consult with your professional advisor about your situation before making a charitable gift.

Looking for other ways to give?

Whether you choose a one-time donation, set up a recurring monthly gift, or leave us in your will, you can trust us to make the most efficient use of every dollar.

Have questions about membership or giving?