Utilizing retirement assets to make your donation while leaving other assets to your loved ones can help you avoid taxes for your heirs.

One of the easiest and most cost-effective ways to protect the Grand Canyon and the Colorado Plateau, while providing for loved ones, is to direct a portion of your IRA, 401(k), or other qualified retirement plan to the Grand Canyon Trust.

Distributions from a qualified, tax-deferred retirement plan are treated as 100 percent taxable income. The same is true when you leave qualified retirement plan assets to your heirs. However, if you leave those assets to the Trust, there’s no tax.

The details

- Naming the Trust as a beneficiary may result in a reduced income tax burden for loved ones.

- You may choose to continue taking withdrawals from your retirement account during your lifetime.

- If your circumstances change, you may modify your beneficiary designation.

Example

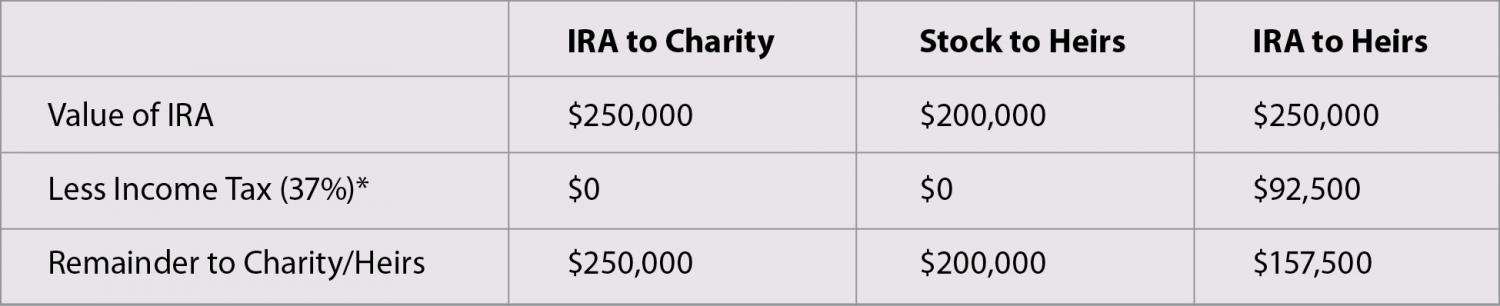

Assume you have $250,000 in an IRA and appreciated stock worth $200,000. If you want to divide those assets between your heirs and the Trust, which assets should you leave where? As you can see from the following chart, by leaving the IRA to the Trust and the appreciated stock to your heirs, you can maximize your legacy and reduce taxes on the transfer of both assets.

In the scenario above, the income your heirs receive from your IRA would be taxed at the highest tax rate. However, the gift of stock wouldn’t generate any taxable income to your heirs since current tax law would adjust the stock shares’ cost basis to their value at the time of your death.

*Example assumes the beneficiary is in the highest current tax bracket.

For more information about supporting the Trust through your retirement plan or through your estate plans, please contact us at (928) 774-7488 or philanthropy@grandcanyontrust.

**Please note the Grand Canyon Trust cannot render tax or legal advice. We urge you to consult with your professional advisor about your situation before making a charitable gift.

Looking for other ways to give?

Whether you choose a one-time donation, set up a recurring monthly gift, or leave us in your will, you can trust us to make the most efficient use of every dollar.

Have questions about membership or giving?