Supporting the Grand Canyon Trust through your IRA is a mutually beneficial way to give. If you are 70 ½ or older, you can make a direct contribution to the Trust from your IRA and have lasting impacts on the places you love. You’ll also save taxes even if you don’t itemize deductions.

If you’re subject to IRS required minimum distribution (RMD) rules from your IRA, your gift can also count toward those required distributions. According to current IRS regulations, you must begin taking withdrawals from a regular IRA at age 72, or 73 if you reach age 72 after Dec. 31, 2022.

The details

- Qualified charitable distributions transferred directly to the Trust from your IRA account will not be taxed.

- Individuals may transfer up to $100,000 annually without incurring income tax on the withdrawal.

- IRA gifts are not subject to the 60 percent annual charitable deduction limitation.

- IRA transfers can be one-time or recurring gifts.

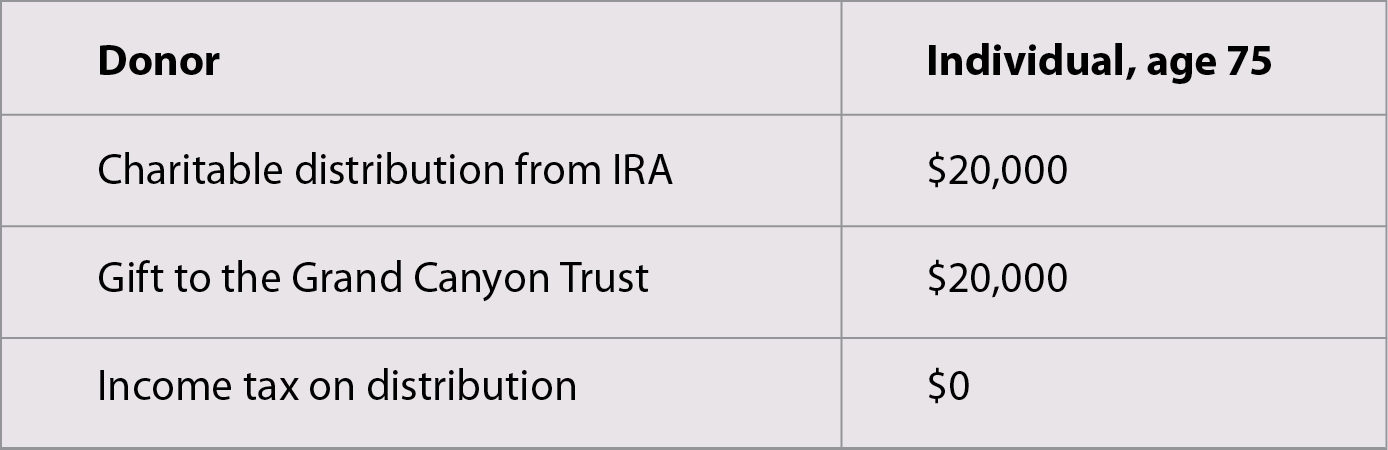

Example

You are 75 years old, married, and plan on claiming the standard deductions ($24,800 in 2020) instead of itemizing tax deductions. You would like to donate to the Grand Canyon Trust, so you instruct your IRA administrator to make a direct distribution of $20,000 to the Trust. Your gift counts toward your annual IRA minimum distribution, so it saves you taxes by reducing your taxable income. And, your gift directly impacts our work to protect the Grand Canyon and the Colorado Plateau.

For more information about supporting the Trust through your IRA, or how to name the Trust in your estate plan, please contact us at (928) 774-7488 or philanthropy@grandcanyontrust.

**Please note the Grand Canyon Trust cannot render tax or legal advice. We encourage you to consult with your professional advisor about your situation before making a charitable gift.

Looking for other ways to give?

Whether you choose a one-time donation, set up a recurring monthly gift, or leave us in your will, you can trust us to make the most efficient use of every dollar.

Have questions about membership or giving?